Bitcoin price hits $70K All-Time High as US jobs data squashes US dollar

Bitcoin hit new all-time highs on March 8 after United States unemployment boosted the case for interest rate cuts. Data from Cointelegraph Markets Pro and TradingView followed buoyant BTC price action as bulls sent the market into price discovery, reaching $70,184 on Bitstamp.

The largest cryptocurrency gained as the latest U.S. jobless data showed unemployment beating forecasts in February, indicating that inflationary pressures were waning at the hands of restrictive economic policy.

The unemployment rate nationwide came in at 3.9% — 0.2% higher than expected, while January figures for jobs added were revised lower.

U.S. dollar gives up gains

The jobs data meanwhile spelled fresh misery for U.S. dollar strength.

The U.S. dollar index (DXY) fell to nearly its lowest levels in two months on the release, bottoming at 102.36 and down nearly 5% versus its year-to-date highs.

The Federal Reserve’s next decision on whether to lower interest rates is due on March 20, with market expectations nonetheless hawkish. The latest estimates from CME Group’s FedWatch Tool put the odds of an impending cut at just 3%. During the week, Fed officials, including Chair Jerome Powell in scheduled testimony, had maintained conservative language over future policy timing.

What Gives Bitcoin Its Value?

Market forces, like Supply and Demand, influence Bitcoin’s price. The price typically decreases when there are more sellers or vice-versa.

Bitcoin (BTC) is a digital coin, which is not issued by any government or legal body, in contrast to fiat currencies like the dollar, pound and euro. To create, store and move BTC, a network of users and cryptographic protocols are required.

Investors, carry out their commercial transactions directly, as opposed to using a middleman. The peer-to-peer network removes trade restrictions and streamlines commerce. Satoshi Nakamoto first proposed the world’s first cryptocurrency in 2008, which was launched in January 2009.

The number of businesses accepting Bitcoin is growing daily, giving it a real market value. However, this virtual currency has been severely hampered by security issues and volatility.

The same market dynamics, supply and demand, that affect the price of other goods and services, also decide the value of Bitcoin. Prices will probably rise if there are more buyers than sellers or vice-versa. It`s essential to note that the price of Bitcoin is not determined by a single entity nor can it be traded in a single location. Based on supply and demand, each market or exchange sets its price.

What Factors Could Impact Bitcoin’s Price?

Various factors impacting Bitcoin’s price include the supply and demand of BTC, competition from other cryptocurrencies and news, cost of production and regulation.

1) Supply & Demand

As per this law, supply and demand market forces work together to determine the market price and the quantity of a specific commodity. For instance, the demand, for an economic good declines, as the price increases, and sellers will produce more of it or vice-versa.

An event known as Bitcoin Halving, impacts the Bitcoin’s price like the situation in which the supply of BTC decrease whereas the demand for BTC increases. As a result of the high demand, the price of BTC will move upward.

In addition, Bitcoin was created by Satoshi Nakamoto with a 21 million BTC hard cap. That said, miners will no longer receive new Bitcoin for confirming transactions once that cap has been reached. The four-year halving of block rewards might not affect the price of BTC at that point. The things that will determine Bitcoin’s value will instead be its real-life application.

2) Competition & News

BTC faces competition from altcoins like Ethereum (ETH) and coins like Terra (LUNA), making portfolio diversification appealing to investors. Any upgrades by the existing cryptocurrencies might drive BTC’s price down in contrast to a completely different scenario in which Bitcoin was the only existing digital currency. Due to media coverage, you may want to buy crypto assets with a positive outlook and ignore those with a shady future.

3) Cost of Production

Production costs for Bitcoin include infrastructural expenses, electricity charges for mining and the difficulty level of the mathematical algorithm (indirect cost). The various levels of difficulty in BTC’s algorithms can slow down or speed up the currency’s production pace, impacting Bitcoin’s supply, which, in turn, affects its price.

4) Regulation

Cryptocurrency regulations are constantly changing, from countries like El Salvador accepting it as a legal tender to China formally banning crypto transactions. The price of BTC could decrease if there is concern over a specific government’s decision against cryptocurrencies. Additionally, regulatory uncertainty will create fear among investors, dipping Bitcoin’s value even further.

Why is the Bitcoin Price so Volatile?

Uncertainty regarding the intrinsic value of Bitcoin and BTC’s future value makes it a highly volatile asset.

A decreasing amount of new BTC is created each day since a finite quantity of Bitcoin exists. To maintain a steady price, demand must match this inflation rate. The Bitcoin Market is quite small compared to other industries, and media coverage alone can drive its price up or down.

For instance, news about a multinational corporation’s willingness to accept BTC will drive its value upwards or vice-versa, making Bitcoin’s price highly volatile.

Similarly, a tweet that The Bitcoin Blockchain has been halted will drive its value down, followed by Bitcoin’s Trading Volume.

Since The Price of BTC is not pegged to any fiat currency like The U.S. Dollar or any other Real-World Asset; it is susceptible to value crashes. Nevertheless, an extended bull market, will appear in advance to allow investors to protect their funds. Also, Bitcoin’s complex architecture is not easy to destroy; so we can safely say… there’s BTC for a very long time.

○♢○

El Salvador´s Largest Bank Partners With Flexa On Bitcoin Payments!

On September 9, Pure-Digital Payments Network Flexa announced that it has partnered with the Central American country’s largest bank, Bancoagrícola; that Will Allow it To Accept Bitcoin Payments for its loans and credit cards; as well as at its Merchant Payment Network’s Members.

The Bank’s Customers can now use any Flexa or Lightning-Enabled Wallet App to make Bitcoin Payments on Bancoagrícola financial products. The companies promised these would be “at the exact fair market rate”.

○♢○

Bitcoin Payments On Shopify Via New Partnership…

Binance Pay users will be able to pay across merchants of Alchemy Pay’s partners, including e-commerce giant Shopify and software technology firm Arcadier.

Binance, The World’s Largest Cryptocurrency Exchange by Trading Volumes, continues actively expanding into The Crypto Payments Industry through a new crypto-to-fiat integration.

The Company Announced Tuesday a Partnership with Crypto-Fiat Hybrid Payment Platform Alchemy Pay to enable peer-to-peer (P2P) crypto payments at Over 2 Million Global Merchants through its payments application Binance Pay.

The new integration will allow users and merchants to pay and accept payments using 40 supported cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) in 18 countries where Alchemy Pay operates. Binance Pay Users will be able To Pay Across Merchants of Alchemy Pay’s Partners, including e-commerce giant Shopify, software technology company Arcadier, mobile payment provider QFPay and others.

Alchemy Pay CEO John Tan said that Alchemy Pay’s Partnership with Binance “significantly expands the practical backbone applications we build between the crypto and fiat worlds.” He also noted that the total value of the crypto market was “less than a tenth of a percent of what it is today” when Alchemy Pay was launched.

As previously reported, Binance Pay is a contactless P2P Crypto Payment Feature on Binance, Allowing Users To Send and Receive Crypto Payments Around The World. The app was launched in public alpha this March and is Available To All Eligible Binance Users.

○♢○

NCR Corporation Plans To Purchase Bitcoin ATM Company LibertyX!

LibertyX currently services 20,000 retail stores in the U.S. with 9,500 crypto ATMs.

Enterprise technology provider NCR Corporation has announced an agreement to buy LibertyX, the company that launched one of the first retail Bitcoin ATMs.

In a Monday announcement, NCR said it expected to purchase LibertyX later this year depending on regulatory licensing consents and approvals. The firm said it planned to offer LibertyX’s capabilities as part of its solutions for banks, retailers and restaurants, implying NCR clients could see crypto withdrawals, purchasing and payment features after the deal is finalized.

“Our customers require a complete digital currency solution, including the ability to buy and sell cryptocurrency, conduct cross-border remittance and accept digital currency payments across digital and physical channels,” said NCR chief technology officer Tim Vanderham.

LibertyX has allowed users to make purchases with crypto at a variety of retailers in the United States using its mobile app or through its network of Bitcoin (BTC) ATMs. According to the firm, it currently services 20,000 retail stores in the United States with 9,500 crypto ATMs.

According to data from CoinATMRadar, there are more than 24,481 crypto ATMs in the world at the time of publication, with the market experiencing exponential growth in 2021. Bitcoin Depot, one of the largest holders of the Bitcoin ATM network, recently announced a partnership with convenience store Circle K, resulting in the installation of more than 700 Bitcoin ATMs in the U.S. and Canada.

○♢○

Crypto Lender Celsius Confirms $54M Investment In Miner Core Scientific!

The funding is part of Celsius’ planned $200 million investment in Bitcoin Mining in North America, according to the company. Celsius said the investment, which occurred during the second quarter, would make it one of the largest U.S. investors in the bitcoin mining industry.

Celsius CEO Alex Mashinsky described the deal as “good for our community.” He added: “They (Core Scientific) have a lot of assets. That’s safer than just investing in a DeFi project.”

The announcement comes just two days after Core Scientific said that it planned to list its shares on Nasdaq through a merger with Power & Digital Infrastructure Acquisition. The miner will have a value of $4.3 billion.

In May, Michael Levitt, the Co-Founder and Chairman of Core Scientific, took over as CEO after Kevin Turner stepped down.

Mashinsky sees these developments positively, noting that the merger would allow Core “to raise even more money.”

“Companies go through changes all the time,” he said.

He also highlighted Core’s carbon-neutral infrastructure. Mashinsky said that last month, Celsius had joined the Bitcoin Mining Council, the voluntary organization of miners and high-profile members of the Bitcoin community concerned about mining’s environmental impact.

In the company’s statement, Mashinsky said that Celsius was “looking forward to working together to grow our joint business in the future.”

○♢○

New Jersey Pension Invested $7M In Bitcoin Mining Stocks Last Quarter…

New Jersey’s pension fund chased crypto mining’s upside last quarter with multimillion-dollar bets on two of the industry’s biggest names.

The state-managed pension ended June with $3.66 million in Riot Blockchain (NASDAQ: RIOT) and $3.39 million in Marathon Digital Holdings (NASDAQ: MARA), according to disclosure documents.

New Jersey’s Common Pension Fund D has $30 billion in total assets for state employees.

The allocation appears to be New Jersey’s first in the crypto sector. Other state-run pension schemes have also warmed up to Bitcoin Mining Stocks in recent months, most notably California’s.

○♢○

Bank of America Approves Bitcoin Futures Trading!

Bank of America, the second-largest bank in the U.S., has approved the trading of bitcoin (BTC) futures for some clients.

Like most institutions, the bank has been conservative in its approach to the crypto sector, but due to the large amount of margin required to trade the futures, it is now allowing some clients to access the crypto market, one of the sources said. Some clients are setting up to trade bitcoin futures, which are cash settled, and one or two may have already gone live, the other source said.

A number of investment banks are reportedly allowing clients to invest in Crypto Products. In March, Goldman Sachs confirmed plans to relaunch its cryptocurrency trading desk after a three-year hiatus, and in May, the investment bank started buying and selling bitcoin futures in block trades through Chicago Mercantile Exchange (CME) Group, using Cumberland DRW as its trading partner.

○♢○

PayPal Allows U.S. Consumers To Buy $100,000 Of Crypto Per Week!

PayPal has announced that it will now allow customers in the U.S. to buy up to $100,000 in crypto per week.

That’s a substantial increase from the $20,000-a-week limit that had been in force since the platform’s Crypto Service launched last October.

PayPal also stressed that it is regularly updating its educational materials on cryptocurrency to “help demystify some misconceptions customers may have about crypto.”

This service allows PayPal Users to buy, sell and hold Digital Assets.

A recent change means that crypto owners on the site can also use these coins to make purchases at millions of merchants around the world.

The company appears to have been incredibly enthusiastic about the impact that its crypto division has had. PayPal’s CEO Dan Schulman has said the payments giant has a roadmap to introduce a range of new features, adding that data appears to show people who Buy Crypto through its site tend to log in more.

○♢○

S&P Dow Jones Indices Launches New Cryptocurrency Indexes!

S&P Dow Jones Indices, the leading index provider of some of the world’s largest equity benchmarks, has launched a new cryptocurrency index that tracks the performance of the broader digital asset market.

The S&P Cryptocurrency Broad Digital Market Index, labelled BDM, tracks more than 240 digital assets at launch and represents an expansion of the firm’s recently launched crypto benchmarks.

In addition to BDM, the company also launched four other crypto-focused indexes on Tuesday, each tracking various components of the broad digital market benchmark. These include:

- S&P Cryptocurrency LargeCap Index

- S&P Cryptocurrency BDM Ex-MegaCap Index

- S&P Cryptocurrency BDM Ex-LargeCap Index

- S&P Cryptocurrency LargeCap Ex-MegaCap Index

All the indexes rely on pricing information from Lukka, a crypto-focused data provider, to determine the composition of each respective benchmark.

By recognizing cryptocurrencies and developing pricing benchmarks for investors to use, Dow Jones Indices brings a new level of legitimacy to the evolving digital asset market. For many investors in the cryptocurrency space, broader recognition from Wall Street could catalyze the sector to new highs in terms of adoption and value.

○♢○

Visa Milestone…

Visa has entered into a partnership to allow more than 50 companies to use its card program, enabling consumers to spend and convert cryto. It’s hoped this will make it easier for consumers to use digital assets at more than 70 million merchants around the world, even those that don’t accept it. Basically, It will be the same as any other Visa transaction to them. But on the backend, the crypto assets are instantly converted into fiat.

○♢○

Marathon Digital Reports 17% Increase In Bitcoin Production For June…

Marathon Digital Holdings generated 265.6 bitcoins during June, a 17% increase over the previous month, the company said in a press release last Friday, July 2nd. That total brought the publicly traded bitcoin mining company’s Q2 haul to 654.3 bitcoins, more than three times the nearly 191.7 bitcoins it produced over the first three months of 2021.

Las Vegas-based Marathon said that it now holds approximately 5,784 bitcoins at a value of $201.6 million based on a July 1 price of $34,855 per bitcoin, including 4,182 bitcoins that it bought in January as part of its effort to become what former CEO Merrick Okamoto called a “pure-play bitcoin investment option.” Marathon is scheduled to report earnings on Aug. 13.

The company said that it had installed 1,740 miners in June bringing its fleet to 19,395 miners. Earlier this year, the company promised to reach a goal of installing more than 100,000 miners by the end of Q1 2022 that will boost its hash rate power to 10.37 exahashes per second (EH/s). The company’s current miners generate 2.09 EH/s).

Marathon also said that it had received 18,702 S-19 Pro ASIC miners from Bitmain this year with an additional 1,056 Pro ASIC miners in transit, and that it had completed construction of containers for mining rigs at its Hardin, Montana, facility.

The company will install 12,000 miners at the Hardin location by the end of September 2021and then begin placing 73,000 miners at a 300-megawatt facility in Texas hosted by Compute North.

Marathon’s current CEO Fred Thiel said in the press release that Marathon had performed “maintenance and upgrades” on systems before deliveries of miners accelerated, and in anticipation of a decline in global hashrate. “We are now better prepared to receive the large upcoming shipments and take advantage of expected favorable mining conditions,” said Thiel.

○♢○

Athena Confirms Plan To Bring 1,500 Bitcoin ATMs To El Salvador!

U.S. company Athena intends to supply El Salvador’s new crypto-based economy with 1500 Bitcoin ATMs, a company representative has confirmed.

The rollout will start small, trialing a few dozen machines to establish a business model. The Chicago headquartered firm plans to invest more than $1 million to install cryptocurrency ATMs, targeting regions where residents receive remittances from abroad.

Along with installing the new machines it will also hire staff and open an office to carry out operations in El Salvador.

Athena currently operates two ATMs of this type in El Salvador, one at El Zonte beach and the other in El Tunco, as part of an experiment called “Bitcoin Beach” aimed at making the town one of the world’s first crypto economies.

○♢○

El Salvador’s Bitcoin Reward…

New details about El Salvador’s plans to embrace Bitcoin have emerged — with the president confirming that every adult will be eligible to receive $30 of the cryptocurrency as a reward for downloading the government’s official electronic wallet. “Chivo”.; confirming that Bitcoin will become legal tender on September 7th.

The new app will facilitate instant conversions from Bitcoin to dollars and vice versa. The Chivo app will pave the way for Salvadorans working abroad to send funds home to their loved ones immediately — without having to spend a minimum amount or go through an intermediary. The government has completed its roll-out of 200 new physical Bitcoin ATM branches, dubbed “Chivo Points” or “Chivo ATMs.”

○♢○

Morgan Stanley Buys Over 28,000 Shares Of Grayscale Bitcoin Trust!

Megabank Morgan Stanley has purchased 28,289 shares of Grayscale Bitcoin Trust through its Europe Opportunity Fund, according to a U.S. Securities and Exchange Commission filing.

Morgan Stanley has been increasingly active in the cryptocurrency space in recent months to meet growing demand from its clients. In April, the firm allowed a handful of its funds to invest indirectly in bitcoin (BTC, +3.99%) through cash-settled futures contracts and Grayscale’s Bitcoin Trust, including the Institutional Fund, Institutional Fund Trust, Insight Fund and Variable Insurance Fund.

Each fund may invest up to 25% of its assets in bitcoin, according to earlier SEC filings. The Europe Opportunity Fund includes a mix of Europe-based companies in the technology and non-technology space, and other investments. Morgan Stanley Approves Bitcoin Exposure for Select Mutual FundsMorgan Stanley is the latest institution embracing crypto with the approval of bitcoin exposure for a handful of mutual funds. “The Hash” panel discusses the importance of banks gaining exposure to bitcoin and how this will impact the wider crypto ecosystem.

○♢○

Bullish Momentum Ahead!

A survey of Chief Financial Officers suggests that hedge funds are planning to significantly increase their exposure to cryptocurrencies in the coming years.

On average executives expect to hold 7.2% of their assets in crypto by 2025, the inter trust poll indicates. This would be worth $312 billion, if it were to be replicated across the whole hedge fund.

Another interesting insight relates to the Altcoins the investors are most bullish about. Cardano tops the list at 55%, followed by Dogecoin at 11%. Chainlink and Polkadot are tied at 6%.

○♢○

Digital Euro Could Be Necessary For Financial Stability…

The European Central Bank has warned its 27 member states that failing to issue a digital currency could weaken the euro and even cause the EU to lose control of its monetary policy.

The report, titled The International Role of the Euro, urges members to pay attention to “the risks to stability that might arise if a central bank does not offer a digital currency.”

While noting prominently that a currency’s global appeal relies mostly on “fundamental economic forces, which digitalization is unlikely to alter,” the report focused in on the threat that private digital currencies issued by “foreign tech giants” could come to dominate both domestic and cross-border payments.

The report came just days after U.S. Federal Reserve Governor Lael Brainard said much the same thing, warning of “a risk that the widespread use of private monies for consumer payments could fragment parts of the U.S. payment system in ways that impose burdens and raise costs for households and businesses.”

The ECB report said that a private digital currency could “threaten the stability of the financial system” the report issued by ECB President Christine Lagarde noted that “individuals and merchants alike would be vulnerable to a small number of dominant providers with strong market power.”

Beyond that, the report said that without a digital euro, “the ability of central banks to fulfill their monetary policy mandate and role as lender of last resort would be affected.”

○♢○

Coinbase Visa Now Offers Up To 4% Crypto Back!

Top U.S. crypto exchange Coinbase is adding rewards of up to 4% crypto-back to Coinbase Visa holders who use their cards on either Apple Pay or Google Pay.

The offer will only be good for specially selected customers on the waitlist for a Coinbase Visa debit card, so if you haven’t already applied, the loyalty program may be just the push you need to do so.

Using the Coinbase card on either of the mobile payment apps will make participant eligible to receive either 1% of their everyday purchases in Bitcoin, or 4% in Stellar Lumens.

It is not alone in this. Competitors Gemini BlockFi and SoFi either have or have announced crypto reward credits.

The BlockFi Rewards Visa Signature Credit Card and Gemini Credit Card are also both been wait listed. BlockFi offers 1.5% back in BTC on all purchases, rising to 2% if you spend $50,000 annually. There’s a three-month sign-up bonus of 3.5%. Gemini splurges for 3% in Bitcoin or any crypto the exchange lists for dining, 2% on groceries, and 1% on other purchases.

Coinbase will automatically convert all cryptocurrency to US Dollars and transfer the funds to your Coinbase Card (less conversion fees) for use in purchases and ATM withdrawals.

○♢○

Total Stablecoin Supply Crosses The $100 Billion Mark!

The total supply of stablecoins stands at $100.33 billion. Most of that growth has been driven by the two largest stablecoins: Tether’s USDT and the Centre consortium’s USD Coin (USDC).

Tether has a 62% market share, while USDC has a 21% share, although USDC’s market share has been increasing at a faster clip in recent weeks. Late last year, USDC’s market share was less than 10%.

The sharp growth in stablecoins suggests that crypto market participants are increasingly deploying funds, including in areas such as derivatives and decentralized finance (DeFi). Derivatives traders often use stablecoins for collateral, whereas DeFi users utilize stablecoins to trade and lend funds to earn yields.

Stablecoins allows crypto market participants to move faster between trades without having to wait days compared to fiat money transfers. Also, not all crypto exchanges support fiat on-ramps, leaving stablecoins and other cryptocurrencies the only solution to trade crypto.

○♢○

Cardano (ADA) Price Gains 15% Following Smart Contracts Rollout Plan…

Cardano has seen bullish price action over the weekend following further updates on its upcoming smart contracts rollout plan.

Cardano (ADA) tapped $1.70 on Sunday as the cryptocurrency regained fourth place above Binance coin (BNB).

The huge sell-off took its toll across the entire market. With the total market capitalization declining by over 53% from its May high. Declining from $2.57 trillion to a monthly low of $1.19 trillion.

○♢○

Cardano Updates Sees Bullish Price…

ADA had previously reached a new all-time high of $2.47 before the BTC correction saw price decline. The price has since recovered from its monthly low of $1 to reclaim the $1.60 mark.

In doing so, the crypto reclaims fourth spot from BNB. Cardano recently announced its plans for its smart contract rollout, called Alonzo. The multi-phase rollout will see a 30, 60, 90 day plan as explained by the Cardano team.

The color-coded series of testnets will start with Alonzo Blue, ending with Alonzo Purple expected to conclude somewhere around September 2021 according to the Cardano development update.

The project has seen an influx of growth in 2021 as it continues to build. The most recent milestone by Cardano saw the project hit one million ADA wallets!

Other notable upgrades to the network include the project’s upcoming ERC20 converter. Which will look to make ADA a real competitor against Ethereum.

○♢○

Other Notable Achievements…

Cardano currently has over 2,500 active pools, staking roughly $33.95 billion in ADA. The project has also delegated over $500 million in ADA towards charity-focused initiatives. With over 100 charity organizations across the globe!

○♢○

PayPal Will Allow Users To Withdraw Their Cryptocurrency & Send It To 3rd-Party Wallets!

The firm’s head of blockchain, crypto, and digital products said on Wednesday, May the 26th.

Jose Fernandez da Ponte announced an end to the firm’s initial practice of only allowing users to buy, hold, or sell Bitcoin, Ether, Bitcoin Cash and Litecoin. PayPal runs all of its crypto transactions through Paxos, a blockchain infrastructure provider.

“We want to make it as open as possible,” da Ponte said. “We want to give choice to our consumers, something that will let them pay in any way they want to pay. They want to bring their crypto to us so they can use it in commerce, and we want them to be able to take the crypto they acquired with us and take it to the destination of their choice.”

○♢○

Ethereum Closed Green, For Seven Consecutive Months!

As for today’s price action (May 1st 2021), on crypto exchange Coinbase, the Ethereum price hit $2,944.44 at 18:01 UTC, setting a new all-time high, which is less than $56 shy of the $3,000 level!

- Bitcoin is holding support at the 100-period moving average on the hourly chart. The moving average has been sloping upward for about a week, which points to an improving short-term trend.

- On the daily chart, bitcoin is also above the 50-day and 100-day moving averages and is not yet overbought. Slowing momentum on the weekly chart, however, suggests buyers are still taking profit on rallies.

- For now, BTC is approaching the next level of resistance of $60,000, which triggered short-term overbought conditions during the past few months.

○♢○

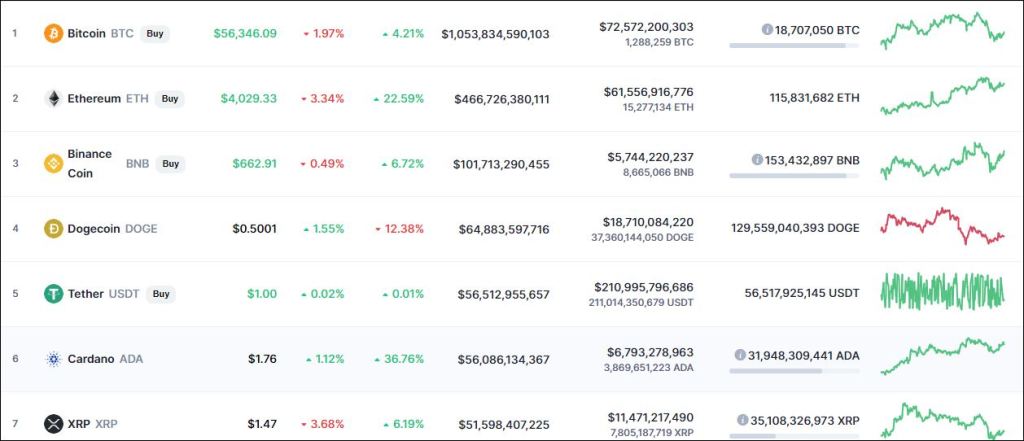

May 28th…

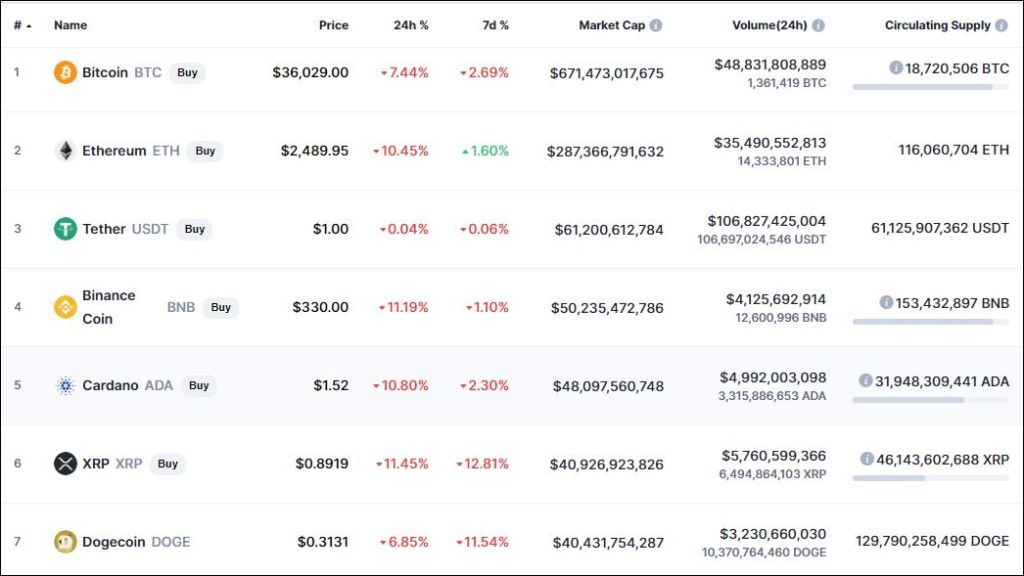

May 11th…

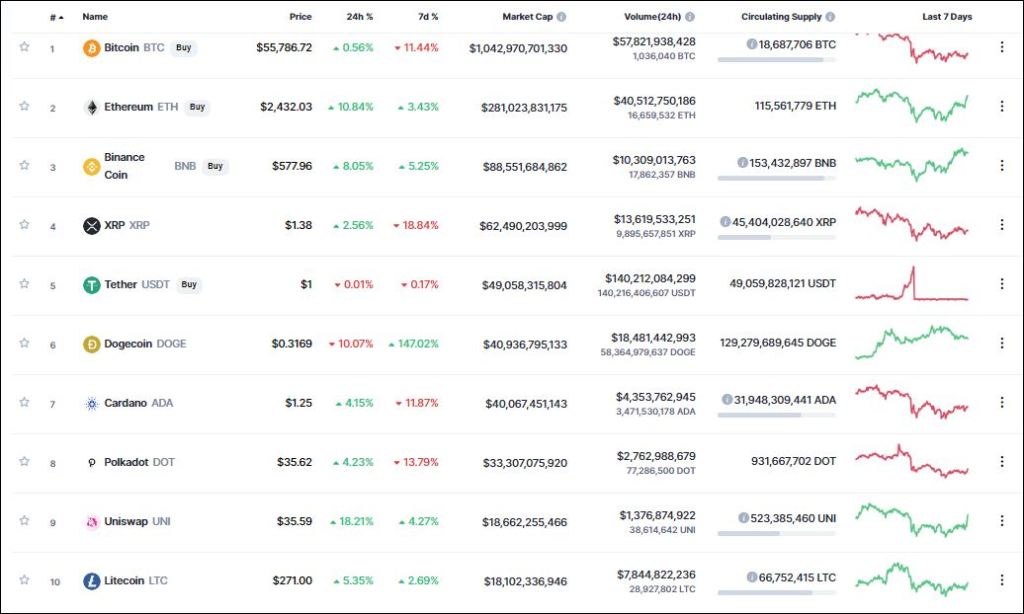

May 7th…

TOP 10 COINS

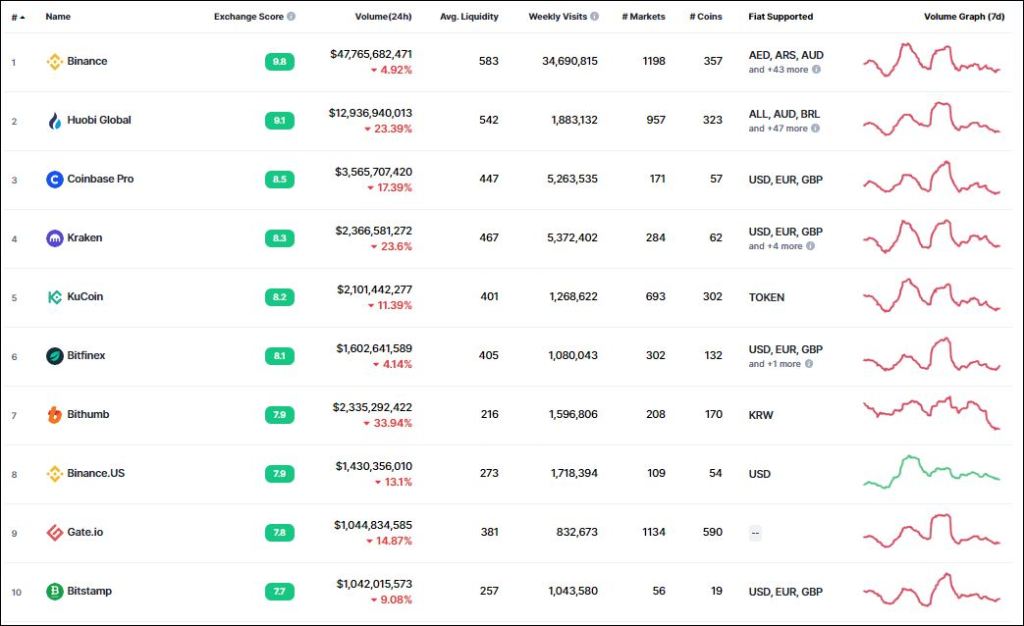

TOP 10 EXCHANGES

You must be logged in to post a comment.